|

|

06-04-2021, 09:48 AM

06-04-2021, 09:48 AM

|

#2671

|

|

Registered User

Join Date: Sep 2007

Location: Boston+Ocala

Posts: 23,731

|

Quote:

Originally Posted by FakeNameChanged

McEwen Mining gapped down 9% yesterday on almost double the volume, and nothing in the news on it?

|

MUX was up the most on the way up for gold miners, it got smacked down the most on a bad day for the miners... i love seeing fast price destruction.. the volume was just a little higher than i expected, so even though its up today, i expect a little more of a pullback before a major run to over $2.00 on this cycle.

|

|

|

06-10-2021, 03:40 PM

06-10-2021, 03:40 PM

|

#2672

|

|

Veteran

Join Date: May 2021

Location: NYC

Posts: 1,554

|

Looking at Mutual Funds.......

Just going thru the motions....and looking for safe investments thats more than the .4 I'm getting at Capital One....

I started looking at "sectors"....

My observation is that the different fund families pretty much end up with the same results .....charts look almost identical with its ups and downs..

My question is ...Which are the best Fund Families?

Vanguard, Fidelity, T. Roe Price...etc etc

And should I stand with one only , since they all perform the same?

Any other comments on Mutual Funds would be welcome...

Yes, Mike(PA) ....your disclaimer is noted

GB

|

|

|

06-10-2021, 04:13 PM

06-10-2021, 04:13 PM

|

#2673

|

|

Registered User

Join Date: Sep 2007

Location: Boston+Ocala

Posts: 23,731

|

today the big rise might have had something to do with Kitco projecting $15 copper.

in the spirit of that, i bought a new one today==Red Metal Recources RMES

congratulations to those that stayed with MUX, it broke out of its 52 week high today on its way north.

|

|

|

06-10-2021, 04:18 PM

06-10-2021, 04:18 PM

|

#2674

|

|

Registered User

Join Date: Sep 2003

Location: SouthShore Tampa Bay

Posts: 95

|

Quote:

Originally Posted by geroge.burns99

Looking at Mutual Funds.......

My question is ...Which are the best Fund Families?

Vanguard, Fidelity, T. Roe Price...etc etc

GB

|

Hi GB

Where are your funds now and what type of account? You might want to start wherever your funds are now and see what is available. There is also your debt load to consider that is what financial consultants do so that would be my 1st advice.

Personally, I'm a simple passive investor so for me it is Market Cap ETF's and since I've been s Schwab customer for a long time here are the funds I use.

Taxable Account:

SCHB - US Stocks 60%

SCHF - International Stocks 40%

Non-Taxable Account:

SCHH - US REIT 60%

SWAGX - US Bond 40%

Good luck, Joe.

|

|

|

06-10-2021, 04:20 PM

06-10-2021, 04:20 PM

|

#2675

|

|

Veteran

Join Date: May 2021

Location: NYC

Posts: 1,554

|

Quote:

Originally Posted by lamboguy

today the big rise might have had something to do with Kitco projecting $15 copper.

in the spirit of that, i bought a new one today==Red Metal Recources RMES

congratulations to those that stayed with MUX, it broke out of its 52 week high today on its way north.

|

Didn't quite go thru it yet

Analysts negative on it

it did have a heavy volume day

|

|

|

06-10-2021, 04:22 PM

06-10-2021, 04:22 PM

|

#2676

|

|

Veteran

Join Date: May 2021

Location: NYC

Posts: 1,554

|

Quote:

Originally Posted by JoeLong

Hi GB

Where are your funds now and what type of account? You might want to start wherever your funds are now and see what is available. There is also your debt load to consider that is what financial consultants do so that would be my 1st advice.

Personally, I'm a simple passive investor so for me it is Market Cap ETF's and since I've been s Schwab customer for a long time here are the funds I use.

Taxable Account:

SCHB - US Stocks 60%

SCHF - International Stocks 40%

Non-Taxable Account:

SCHH - US REIT 60%

SWAGX - US Bond 40%

Good luck, Joe.

|

Right now its in the wings....ready to dive in...

|

|

|

06-10-2021, 04:23 PM

06-10-2021, 04:23 PM

|

#2677

|

|

Veteran

Join Date: May 2021

Location: NYC

Posts: 1,554

|

Quote:

Originally Posted by JoeLong

Hi GB

Where are your funds now and what type of account? You might want to start wherever your funds are now and see what is available. There is also your debt load to consider that is what financial consultants do so that would be my 1st advice.

Personally, I'm a simple passive investor so for me it is Market Cap ETF's and since I've been s Schwab customer for a long time here are the funds I use.

Taxable Account:

SCHB - US Stocks 60%

SCHF - International Stocks 40%

Non-Taxable Account:

SCHH - US REIT 60%

SWAGX - US Bond 40%

Good luck, Joe.

|

thxs Joe...plain and simple....like it

|

|

|

06-10-2021, 04:34 PM

06-10-2021, 04:34 PM

|

#2678

|

|

Registered User

Join Date: Sep 2003

Location: SouthShore Tampa Bay

Posts: 95

|

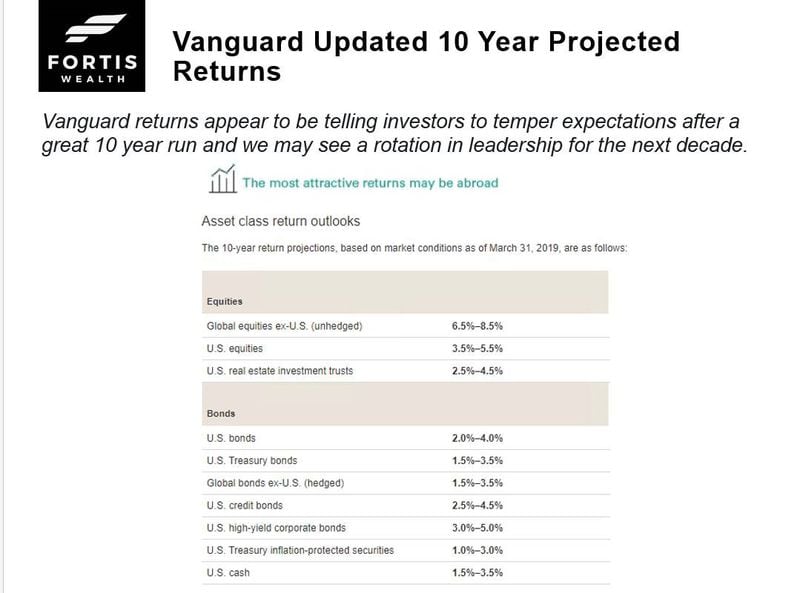

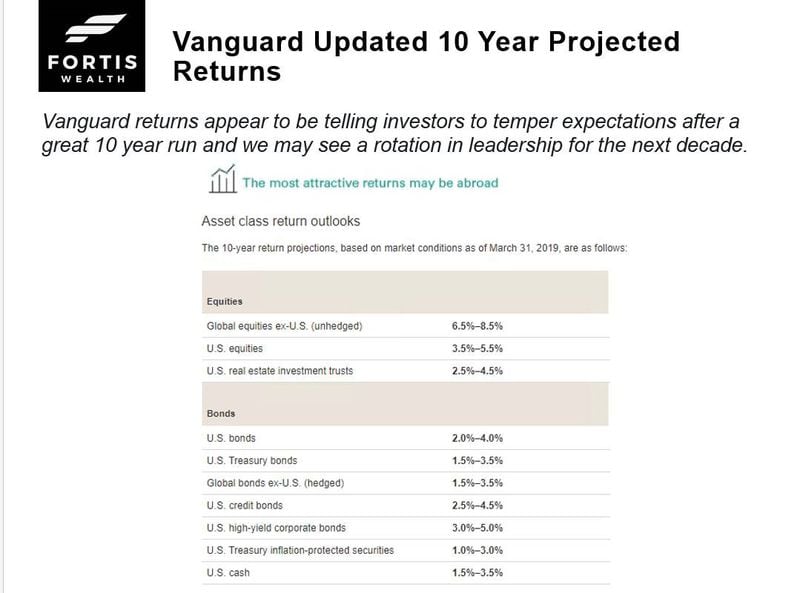

This is what Vanguard is expecting and what I used to speculate with...

All the best.

|

|

|

06-10-2021, 04:37 PM

06-10-2021, 04:37 PM

|

#2679

|

|

Registered User

Join Date: Sep 2007

Location: Boston+Ocala

Posts: 23,731

|

Quote:

Originally Posted by geroge.burns99

Looking at Mutual Funds.......

Just going thru the motions....and looking for safe investments thats more than the .4 I'm getting at Capital One....

I started looking at "sectors"....

My observation is that the different fund families pretty much end up with the same results .....charts look almost identical with its ups and downs..

My question is ...Which are the best Fund Families?

Vanguard, Fidelity, T. Roe Price...etc etc

And should I stand with one only , since they all perform the same?

Any other comments on Mutual Funds would be welcome...

Yes, Mike(PA) ....your disclaimer is noted

GB

|

on the latest 13f filings I saw that Fidelity and Wellington unloaded Apple.

|

|

|

06-10-2021, 04:38 PM

06-10-2021, 04:38 PM

|

#2680

|

|

Veteran

Join Date: May 2021

Location: NYC

Posts: 1,554

|

Quote:

Originally Posted by JoeLong

This is what Vanguard is expecting and what I used to speculate with...

All the best. |

This is as of Mar 2019...any update?

|

|

|

06-10-2021, 04:41 PM

06-10-2021, 04:41 PM

|

#2681

|

|

Veteran

Join Date: May 2021

Location: NYC

Posts: 1,554

|

Quote:

Originally Posted by lamboguy

on the latest 13f filings I saw that Fidelity and Wellington unloaded Apple.

|

NOOOOOOOO

I have a few shares in there......I did make some money in the year and half I had it...

It has been trending slightly down too but not drastically

|

|

|

06-11-2021, 04:38 AM

06-11-2021, 04:38 AM

|

#2683

|

|

Registered User

Join Date: Mar 2004

Location: DC

Posts: 147

|

Quote:

Originally Posted by geroge.burns99

Looking at Mutual Funds.......

Just going thru the motions....and looking for safe investments thats more than the .4 I'm getting at Capital One....

I started looking at "sectors"....

My observation is that the different fund families pretty much end up with the same results .....charts look almost identical with its ups and downs..

My question is ...Which are the best Fund Families?

Vanguard, Fidelity, T. Roe Price...etc etc

And should I stand with one only , since they all perform the same?

Any other comments on Mutual Funds would be welcome...

Yes, Mike(PA) ....your disclaimer is noted

GB

|

The literature suggests that fees are a very important element to consider. Vanguard is actually owned by its mutual fund shareholders and traditionally has low fees.

Cratman

__________________

Cratman

|

|

|

06-11-2021, 06:31 AM

06-11-2021, 06:31 AM

|

#2684

|

|

Veteran

Join Date: May 2021

Location: NYC

Posts: 1,554

|

Quote:

Originally Posted by ReplayRandall

|

I have plenty of leftover rolling paper????

GB

|

|

|

06-11-2021, 07:40 AM

06-11-2021, 07:40 AM

|

#2685

|

|

Registered User

Join Date: Sep 2007

Location: Boston+Ocala

Posts: 23,731

|

there is a company called Monetary Metals where you can ship them your gold or silver, they lease it out for you, and you get 2.2 % dividend every year.. the leases last between 6 months and a year. if you need your metal or cash you can't get it until that particular lease is complete... the metals get leased out to either jewelry companies or bullion dealers.

|

|

|

|

|

| Thread Tools |

|

|

| Rate This Thread |

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

|